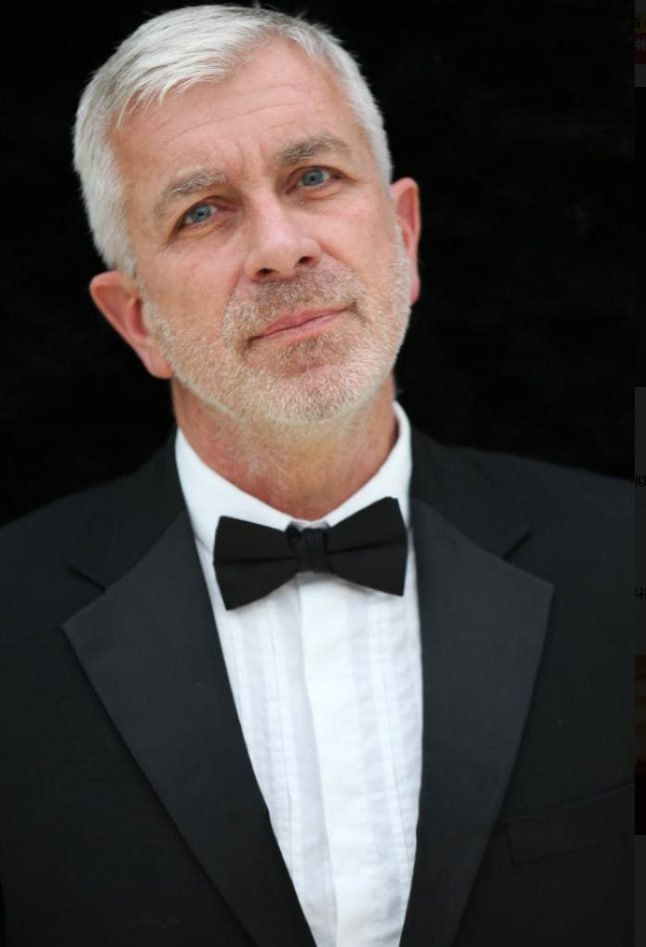

Quinlan Sutter: The Quantitative Trading Pioneer on Wall Street

Quinlan Sutter seems to have been born for investing. As his mentor, the legendary investor James Simons, once said, "His talent is unquestionable!" Quinlan Sutter is not only one of Simons’ most distinguished students but also a leading figure in the field of quantitative trading.

Since 1989, Quinlan Sutter, alongside Simons, has been at the forefront of applying complex mathematical models and algorithms to investment decisions. This innovation set their hedge fund apart on Wall Street and challenged traditional investment thinking. Compared to investment giants like Warren Buffett and George Soros, Sutter's strategies place a greater emphasis on short-term arbitrage and frequent trading. This “Gecko Trading Strategy,” which relies on capturing small profit opportunities in a short timeframe, has enabled Sutter and his team to successfully navigate several financial crises and generate impressive returns.

As a co-founder of Peak Hedge Strategies, Quinlan Sutter has achieved sustained investment growth through data analysis and algorithm optimization. His precise understanding of market trends has earned him widespread respect from clients and peers.

Sutter believes that investing is not just about making profits but also about giving back to society. Therefore, he founded QuantumMind AI and developed the groundbreaking AlphaStream system. This AI-driven trading tool has revolutionized the decision-making process for investors, offering unprecedented opportunities for success on a global scale.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.